Which charitable fund is right for you?

Table of Contents

At Central Florida Foundation, we know that charitable giving is deeply personal—and that choosing the right tools matters just as much as choosing the causes you care about.

Whether you are considering establishing your first fund or considering adding another fund to complement the ones you already have, it can be helpful to step back and look at how different options support different goals.

Which charitable fund is right for you?

Donor Advised Fund

- Flexible & streamlined

- Establish now, give over time

- Person & private

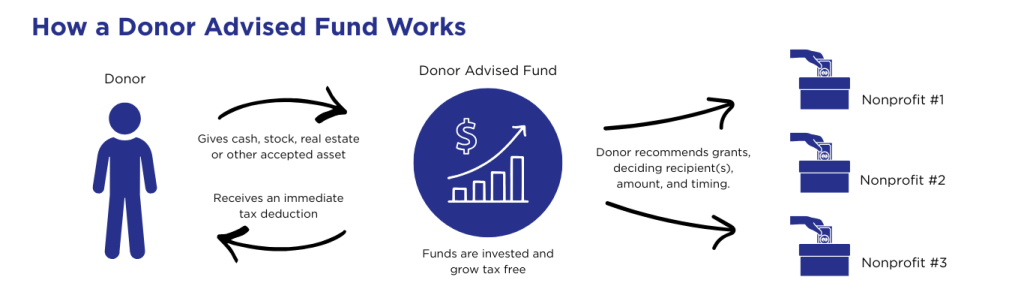

Donor advised funds (DAFs) are one of the most popular “baseline” charitable giving tools because they make it simple to support a wide range of nonprofits while maintaining a clear, organized approach to philanthropy.

With a donor advised fund, you can make contributions of cash, stock, or other property at your convenience, and these gifts are eligible for a charitable tax deduction in the year of the gift. Separately, the donor advised fund allows you to recommend grants to your favorite nonprofits over time. You can select a name for your donor advised fund and, if you choose, remain anonymous to the receiving organization(s).

Designated Fund

- Focused impact

- Reliable funding for your favorite organization(s)

- Efficient planned giving tool

Perhaps you are instead (or also) focused on making a lasting impact on a single organization that has played an important role in your life. In that case, a designated fund may be the right fit for your charitable portfolio. A designated fund provides ongoing, predictable support to a specific nonprofit—either through regular distributions or grants made as needed. Because Central Florida Foundation provides stewardship of the fund’s assets, a designated fund offers stability and continuity for the organization it benefits.

This type of fund can be especially helpful if you want to “bunch” multiple years of giving into a single year for tax purposes while ensuring continued support for a favorite charity over time. Plus, if you are age 70 ½ or older, a designated fund (unlike a donor advised fund) can receive Qualified Charitable Distributions from your IRA.

Unrestricted Fund or Area of Interest Fund

- Community-driven impact

- Expert guidance

- Enduring legacy

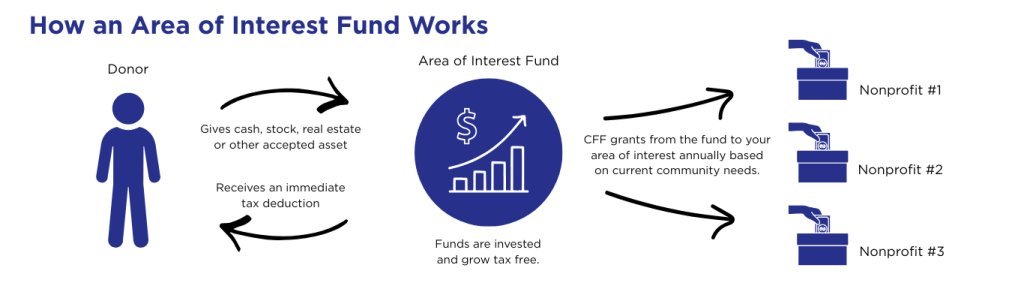

Some donors are drawn to a different approach: addressing the community’s most pressing needs, both now and in the future, while relying on professional insight to guide that work. For these donors, an unrestricted fund offers powerful flexibility. Unrestricted funds allow Central Florida Foundation to direct resources where they are needed most as circumstances change—whether that means responding to a crisis, supporting emerging opportunities, or addressing long-term challenges. These funds play a critical role in the community’s ability to adapt and thrive, and they create a legacy of giving that remains relevant for generations.

An area of interest fund is similar to an unrestricted fund, except that you can name a specific area of need, such as the arts, education, or emergency assistance, to receive support from the fund. If you are age 70 ½ or older, remember that both unrestricted and area of interest funds are eligible recipients of Qualified Charitable Distributions.

Adopt a Portfolio Approach

Many donors choose to establish more than one type of fund over time, building a thoughtful and diversified approach to philanthropy that reflects both their values and their evolving priorities.

Wherever you are along your charitable giving journey, we’re here to help. It is our privilege to partner with you, provide guidance, and support your generosity in ways that strengthen the community we all care about. Please reach out anytime—we would love to talk with you.

Open a Fund at Central Florida Foundation

If you’re ready to establish a charitable fund with us, please fill out our Open a Fund form. If you’d like to talk through your options, please don’t hesitate to reach out to Steven Jerina via the form below or by email at sjerina@cffound.org.

Vice President of Philanthropy Strategies and Partnerships

sjerina@cffound.org | 407-872-3050