Helping Clients Navigate Life’s Curveballs Through Giving

Table of Contents

As an attorney, CPA, or financial advisor, you are no stranger to witnessing the ripple effects of life’s unexpected curveballs. If you represent a client over many years, you’re very likely at some point to help the client through a serious illness, a loved one’s death, business challenges, marital dissolution, strained relationships with children, or all of the above.

Research and survey results tell us that many clients’ most consequential estate and financial planning activities arise not from long-term intentions, but from sudden change. Moments like this are challenging because clients are often overwhelmed and unsure how to proceed, and even the best advice can feel like too much information delivered too soon.

In these situations, charitable planning can often help re-anchor clients’ decision-making in values rather than fear or urgency. For many clients, generosity is one of the few topics that still feels familiar when everything else is shifting.

Helping Clients Navigate Life’s Curveballs Through Giving

Here are three examples.

Change in assets

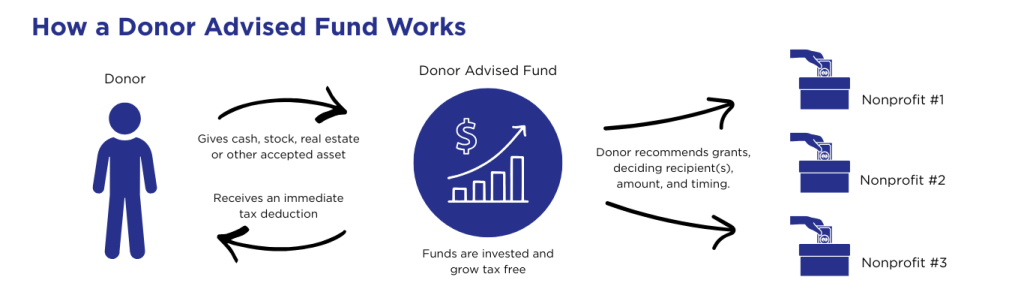

Following a divorce settlement, a client may suddenly be holding cash, concentrated stock, or other highly appreciated assets. The client may also be juggling other priorities: adjusting lifestyle expectations, supporting children, and rethinking an estate plan. When the client also wants to do something charitable but isn’t sure yet what organizations to support, setting up a donor advised fund at Central Florida Foundation can be a natural fit in some cases, allowing the client to be eligible for a tax deduction when the contribution is made while taking time to decide which nonprofits to support and when.

Loss of Spouse

A client whose spouse has recently passed away may want to make a charitable gift in the spouse’s memory, but likes the idea that the gift could benefit the community for many generations and address urgent needs that arise decades from now. Setting up an unrestricted fund at Central Florida Foundation allows a client to support evolving community needs over time, as well as support the mission of the community foundation itself.

Funds, even if unrestricted, can be named in memory of a loved one, allowing the charitable gift to serve as a way to honor a late spouse while also supporting the community for generations to come.

Retirement

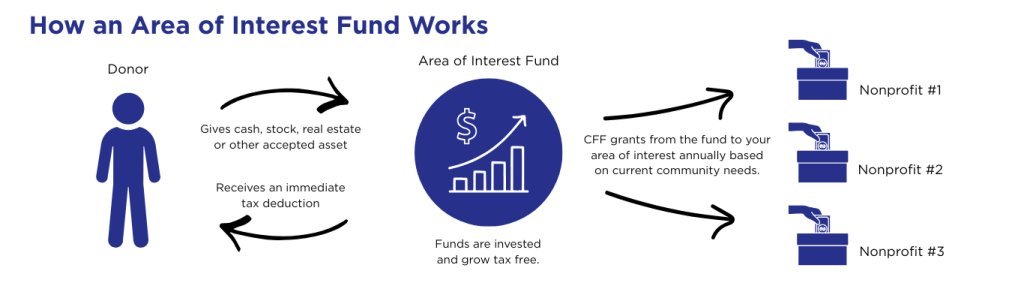

A 74-year-old client who just retired is feeling less “relevant” outside of the workforce, and therefore would like to do something meaningful for the community. With plenty of assets in retirement accounts, the client does not need to rely on distributions from IRAs to maintain lifestyle standards. This client could be a good candidate to establish a designated fund (to support a specific nonprofit organization) or an area of interest fund (to support an area of need such as education, health care, or the arts) at Central Florida Foundation.

Then, the client may direct Qualified Charitable Distributions from IRAs (up to $111,000 per taxpayer in 2026) to the fund, bypassing adjusted gross income and counting toward required minimum distributions (RMDs).

Our team is happy to help. Next time you are meeting with a client who is experiencing one of life’s inevitable rough patches, remember that charitable planning allows your client to take action that brings joy, reflects identity, aligns with purpose, and helps the client shift from a reactive mode to an intentional one.

We’re here to help you.

Whether you have a specific client scenario you’re working through or would like to learn more about our turn-key philanthropic solutions, we welcome the opportunity to talk more.

Vice President of Philanthropy Strategies and Partnerships

sjerina@cffound.org | 407-872-3050