How Advisors Can Leverage Charitable Gift Annuities and Central Florida Foundation

As professional advisors, you play a crucial role in helping clients plan for the future—not just their financial future, but their legacy. With growing interest in values-based planning, many clients are looking for ways to incorporate charitable giving into their retirement and estate strategies. One tool that continues to stand the test of time is the charitable gift annuity (CGA).

In a recent episode of Central Florida Foundation’s podcast, Nicole Donelson, CAP®, and David Torre, CEPA®, CFP®, AEP®, TEP®, CAP®, explore how CGAs can serve both your client’s financial needs and their philanthropic vision. For advisors, understanding this tool—and knowing where to turn for expert support—can add real value to your client relationships.

What Is a Charitable Gift Annuity?

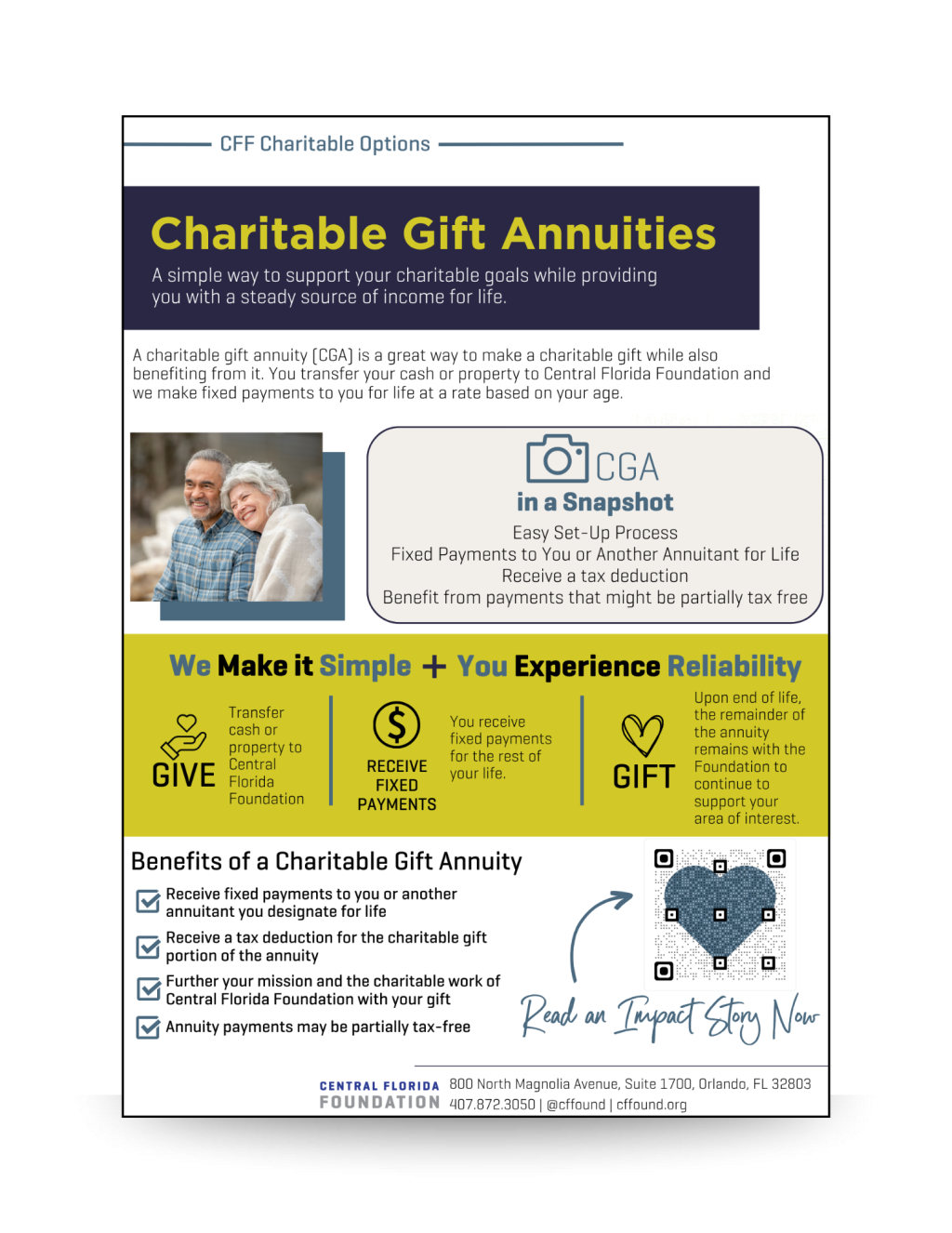

At its core, a charitable gift annuity is a simple agreement between a donor and a nonprofit. The donor contributes an asset—often cash or appreciated stock—and in return, receives fixed income payments for life. When the donor passes away, the remaining funds go to support the nonprofit’s mission.

Unlike commercial annuities, CGAs are part charitable contribution and part income arrangement. That means the donor receives a partial tax deduction, defers potential capital gains if using appreciated assets, and secures predictable payments for life.

It’s a giving tool with a dual benefit: stable income for the donor, and long-term impact for the nonprofit.

Why Should Advisors Care?

Charitable gift annuities are particularly relevant for clients:

- In or near retirement

- Holding low-basis, appreciated assets

- Seeking income stability

- Desiring to make a meaningful charitable impact

In your role as a trusted advisor, CGAs give you the ability to:

- Introduce strategic charitable options during retirement or estate planning conversations

- Optimize your client’s tax situation while helping them give in a way that feels personal and lasting

- Differentiate your practice by offering more holistic, values-aligned advice

David Torre noted on the podcast:

“You might be solving multiple problems for your client at once—income needs, tax efficiency, and charitable intent—all through one simple tool.”

Partnering with Central Florida Foundation

Many advisors hesitate to bring up charitable vehicles like CGAs because they aren’t sure how to implement them—or fear stepping outside their area of expertise.

That’s where Central Florida Foundation comes in.

We don’t just process CGAs—we partner with advisors to deliver seamless, client-centered philanthropic strategies.

Our team provides:

- Custom CGA illustrations and projections

- Administrative support for CGA execution

- Ongoing stewardship that aligns with the donor’s intent

Importantly, we respect your client relationships. We’re here to support—not replace—your role.

Learn more with Central Florida Foundation’s CGA fact sheet.

Case in Point: From Bequest to CGA

One scenario discussed in the episode involves clients who have already committed to a nonprofit through a will. While a bequest is a powerful gesture, it’s revocable and inactive until death. Reframing the conversation to consider a CGA can transform that planned gift into something tangible today—providing the client with income and the nonprofit with a reliable future asset.

In this scenario, it’s not about changing your client’s charitable goals—it’s about elevating them.

The Bottom Line

In today’s planning landscape, charitable gift annuities can be an incredibly effective option—especially for clients in transition, nearing retirement, or eager to leave a legacy.

When you partner with Central Florida Foundation, you’re not only expanding the tools available to your clients, you’re gaining a philanthropic back office, gaining an edge with your client relationships. We provide trusted philanthropic expertise, thoughtful stewardship, and a more meaningful way to give.

Let’s collaborate to turn generosity into impact.

If you’d like to explore how CGAs might fit into your practice—or discuss a specific client case—reach out to us anytime. We’re here to help.

Contact Our Philanthropy Team