Are Donor Advised Funds Still a Relevant Strategy in 2026?

Table of Contents

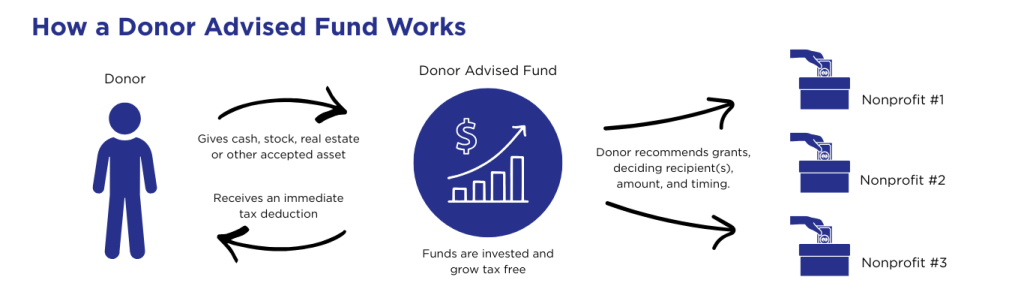

For many CPAs, estate planning attorneys, and financial advisors, the end of 2025 brought a whirlwind of charitable planning activity among high-earner clients. That’s because many taxpayers wanted to maximize the tax benefits of their charitable donations before the 0.5% “floor” and 35% “cap” on charitable deductions kicked in on January 1, 2026, under new tax laws. Donor advised funds in particular played a big role in many late-2025 planning strategies because affected taxpayers could transfer assets to a donor advised fund in 2025, achieve optimal tax results, and then thoughtfully recommend grants to favorite causes and nonprofits from their donor-advised fund in 2026 and beyond.

Are donor advised funds still a relevant strategy in 2026?

Absolutely yes! Donor advised funds remain a highly relevant and strategic tool for your clients. The IRS’s new deductibility limits may reduce the marginal tax benefit of giving for some of your clients, but nothing has changed about the donor advised fund’s broader planning advantages for all of your charitable clients. Here’s why.

4 Reasons Donor Advised Funds Are An Important Strategy in 2026

- A donor advised fund still allows clients to separate the timing of their charitable deduction from the timing of their actual grants to favorite causes and nonprofits, thereby preserving flexibility in years when income is unusually high or coming in handy when planning around liquidity events, even if the deduction is partially constrained under new laws.

- Central Florida Foundation donor advised funds, in particular, provide benefits that extend well beyond the tax code. That’s because of our team’s local expertise, deep knowledge of regional nonprofits, and ability to help your clients align their giving with real community needs.

- When you work with Central Florida Foundation, you can confidently recommend a donor advised fund because you know your client will receive administrative simplicity, concierge-level service, and plenty of opportunities for deep community connections and multigenerational philanthropy. Plus, a donor advised fund with us fuels our community work, giving your clients’ fund two-fold the impact.

- Fundamentally, regardless of tax benefits, your clients’ charitable intent is driven by values, legacy, and a desire for community impact. (No one gives away a dollar to save 35 cents!) That’s why you want to offer your clients the most effective charitable planning vehicles available to achieve charitable goals. A donor advised fund at Central Florida Foundation can play a crucial role in a client’s overall philanthropy structure.

Are there other strategies to consider?

The short answer is: yes, always. While donor-advised funds are the most common and flexible giving tool to use, they aren’t always the best choice, depending on your clients’ situation. One example of this is if a client is looking to make a Qualified Charitable Deduction (QCD) from their IRA. QCDs, in fact, cannot fund a donor-advised fund, which is why Central Florida Foundation offers an alternative charitable fund called an IRA Rollover Fund. An IRA Rollover Fund still allows your client to direct their QCD to support the causes and nonprofits they care about, but with no ongoing advisory role after the initial set-up and with a 10-year sunset.

Our team specializes in understanding a client’s unique goals, constraints, and interests and building a philanthropy strategy to maximize both charitable impact and positive tax outcomes, alongside you, their trusted advisor. We welcome the opportunity to discuss how we can help you offer your clients more.

Donor-Advised Funds in 2026: The Takeaway

In short, donor-advised funds support your clients’ holistic wealth and legacy planning goals – and that’s not changing in 2026. These simple, flexible funds are often the ideal way to achieve your client’s financial and philanthropic goals.

We make it easy for you, as the advisor, to integrate a donor-advised fund into a client’s estate plan, use a donor advised fund to smooth charitable giving over time as a client’s income ebbs and flows, and lean on the donor advised fund as a platform for strategic philanthropy that can evolve alongside a client’s unique life and financial circumstances.

Let’s talk.

Whether you have a specific client scenario you’re working through or would like to learn more about our turn-key philanthropic solutions, we welcome the opportunity to talk more.

Vice President of Philanthropy Strategies and Partnerships

sjerina@cffound.org | 407-872-3050